HDB Just MOP?

See How 19 SG Families Sold Their HDB At Record Prices & Bought 2 Condos With 6 Figure Profits (Typical $100k - $300k) - Exact Numbers Inside

Exact Math: Sale Price Ranges, Fees, Downpayments & New Monthly Outlays - No Fluff, Just Numbers

We Let Results Speak For Ourselves

Why Most Singaporeans Feel It's Impossible To Build Wealth & Support Their Families At The Same Time

Many people in their 30s & 40s feel this pressure.

Working hard, but family money worries are real.

Kids' school fees, future university costs, and parents' medical bills – it's a lot.

You might worry…

'Will there be enough for everyone, including my retirement?'

Everybody wants to have a bigger home for their kids to grow up in, a space for their parents to stay close by.

And certainly have enough saved to enjoy life during retirement. All at the same time.

You know your current property is your biggest asset; it’s meant to be your safety net.

Yet every time you think about selling it to buy two private homes, your chest tightens…

You might think about two mortgage payments every month, and wonder:

“What if the rent stops?”

“What if one of us loses a job?”

“What about ABSD?”

Or perhaps you understand that tying up all your wealth in a single property might limit your future options.

Whether you’re balancing school fees, eldercare bills, and your own retirement fund…

Or watching your property equity sit there without giving you the flexibility you need, it’s easy to feel trapped.

You want to protect your family, but it seems the more you think, the more questions pop up:

How can I give my kids a stable home, care for ageing parents, and still save for myself?

If I sell my current property, how do I make sure one new mortgage isn’t bigger than my last one?

If I buy a second home for rental income, what happens if my tenant moves out or the market dips?

Can I really use my property profits without risking my retirement dreams?

When you picture the typical “sell one, buy two” advice out there, it all sounds like “borrow as much as you can.”

But that can lead to sleepless nights, constant worry, and a bank account that runs dry if something unexpected happens.

But what if I told you that there’s a better way?

An Uncommon Way To Make Full Use Of The Profit From Your Property Sale

Here’s a less common idea:

Instead of small downpayments on two properties and then two big loans, use a large part of your profits to significantly pay down the loan on one new home.

This first home, your new family home, now has a tiny, manageable loan.

Your monthly payments could even be lower than your old property. This means less stress and more cash for you each month.

Then, the second property is a carefully chosen investment.

Its rental income can cover its own mortgage AND contribute towards your kids' education and parents' needs.

This income stream is dedicated to family support, separate from your salary.

You get a stable home, while the second property supports your loved ones.

Your retirement plans can stay protected.

In fact, with family expenses covered by this rental income, you may find you have more to save for your own retirement.

But of course, we understand the hassle of having to go through all the necessary data before making a decision, on top of the busy lives we all live today…

So Here’s How We Can Help You

But of course, we understand the hassle of having to go through all the necessary data before making a decision, on top of the busy lives we all live today…

Review your property’s current value and loan balance, so you know exactly what you have to work with.

Show you how to use most of your sale proceeds to shrink your new family-home loan, so your monthly payment stays reasonable.

Build a simple, low-risk plan so you never borrow more than you can comfortably repay, even if life throws you a curveball.

But due to the time-intensive nature of each consultation, we can only accept families who meet our qualification criteria.

Spots are limited as we also have existing client commitments, so apply now if you’re serious about a safe, step-by-step plan.

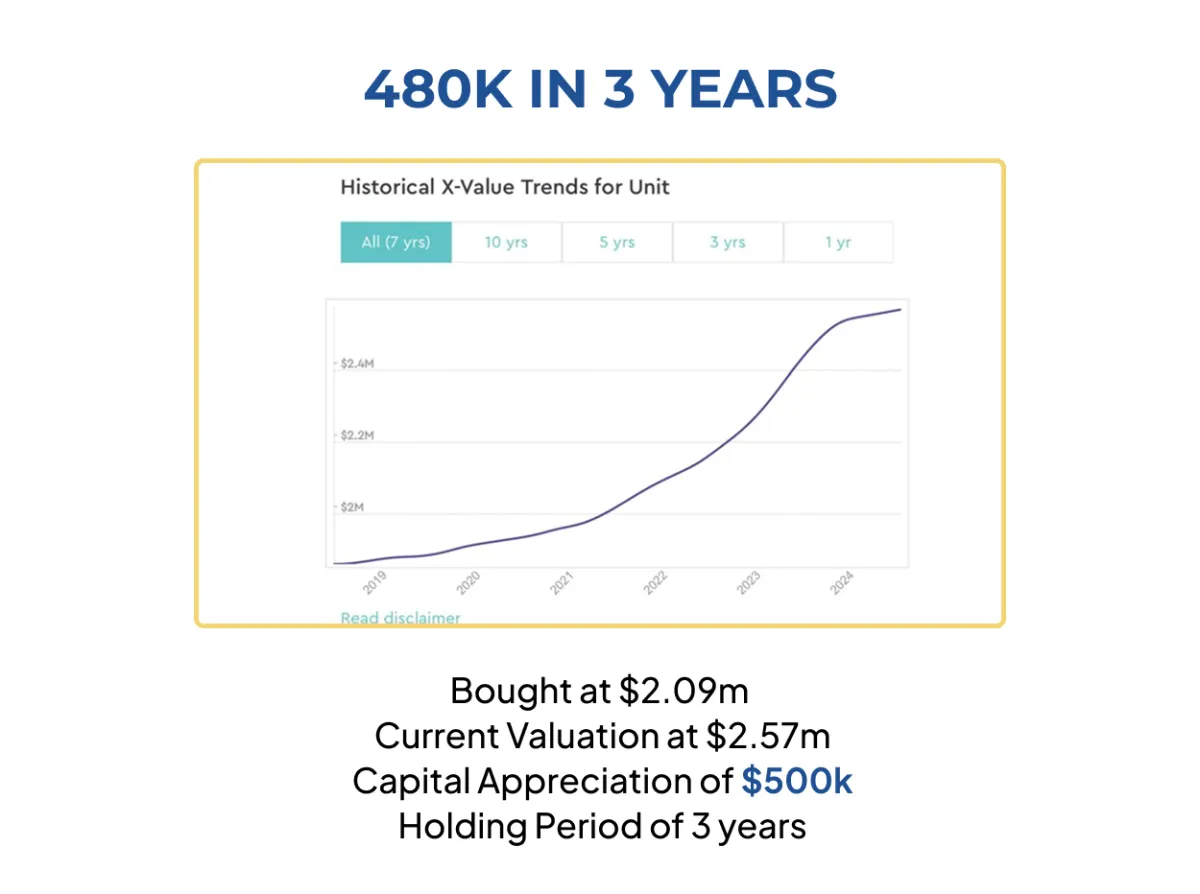

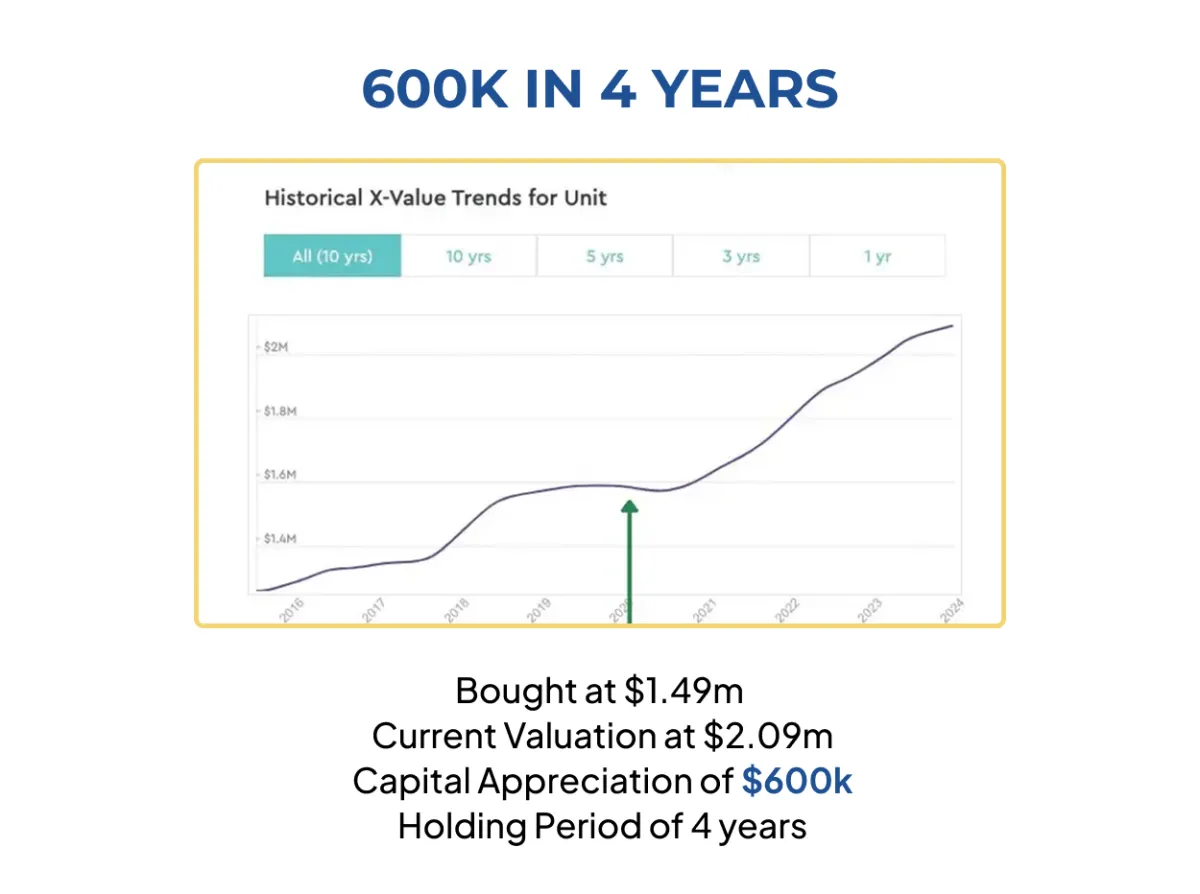

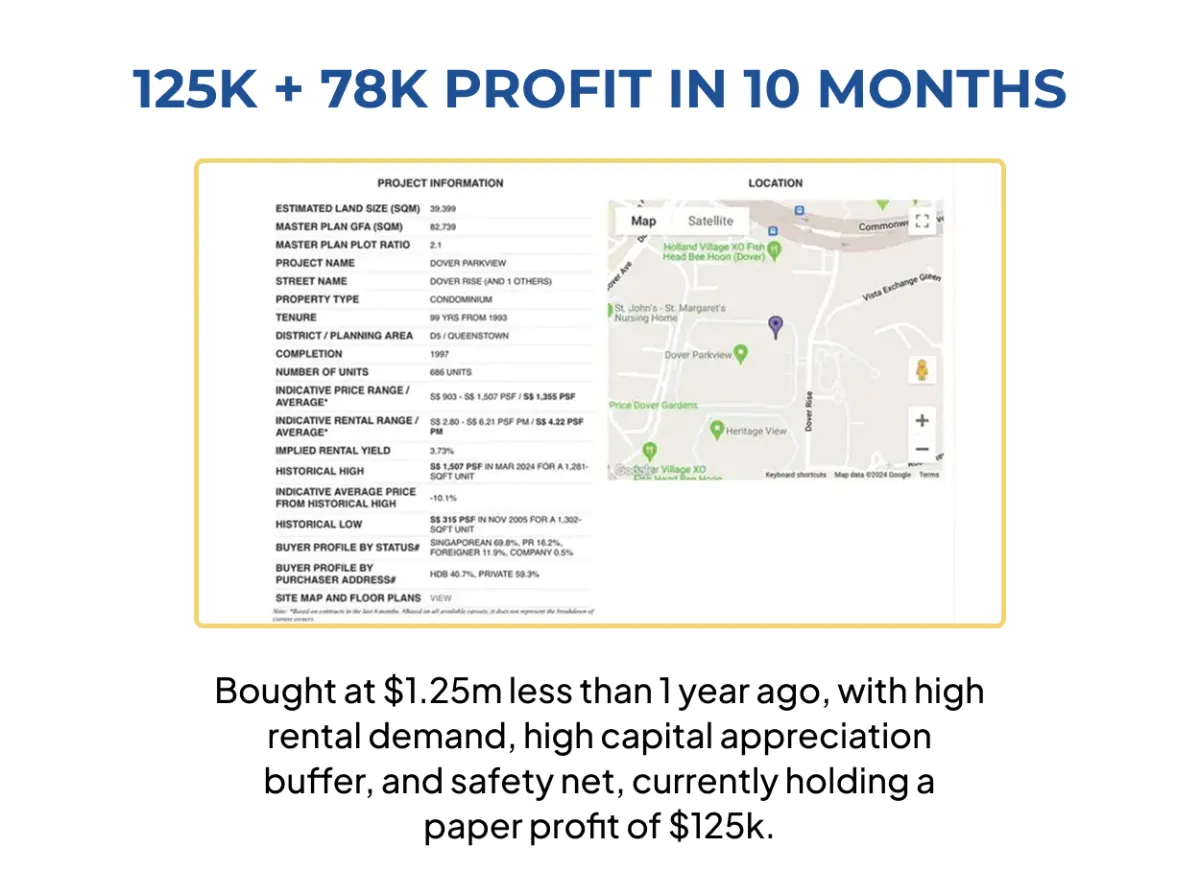

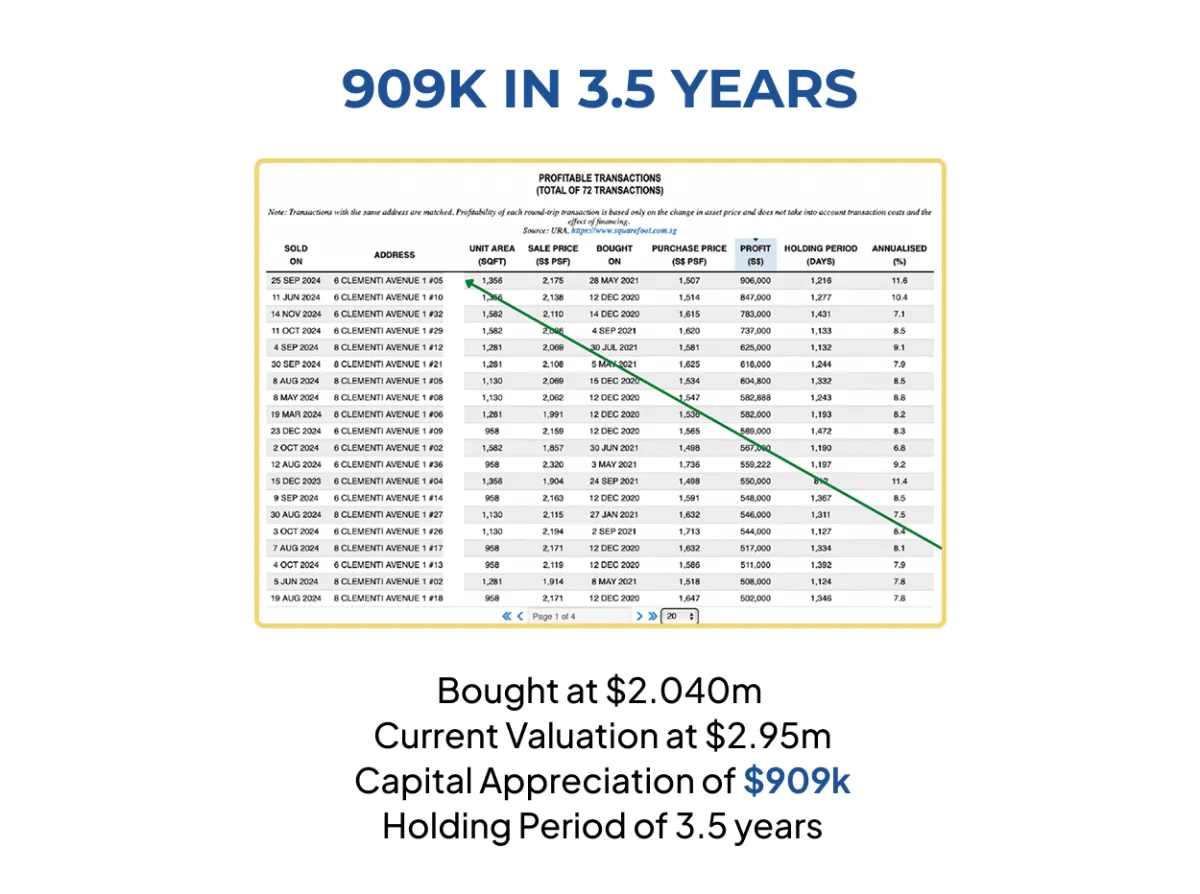

Results From Our Clients At A Glance

Who Are We & Why Listen To Us?

Damien Tan

JNA Team Leader

Clifford Chin

Investment Team Lead

Gerald Lim

Residential Consultant Executive

Sharlene Soh

Sales Specialist

We are Damien Tan Real Estate, proudly part of the JNA Real Estate family.

Over the past few years, our team has guided many families through life-changing property strategies and transacted more than 3,000 homes across Singapore.

700+ Clients Served

19.84% Average Annualised Net Returns

for our investment-home clients

7 in 10 Homes

we sell hit record prices

16,000+ YouTube Subscribers

and the most-watched real estate social channels in PropNex Singapore

Every success story is powered by our full team’s expertise.

From market research and financing strategy to negotiation and after-sales support.

When you work with us, you tap into the strength of our real estate specialists focused on keeping your family secure and your portfolio growing.

Copyright 2025 All Rights Reserved.

Privacy Policy | Terms and Condition

Damien Tan Real Estate

62 Ubi Road 1, Oxley Bizhub 2, Singapore 408734